ESMS on MSME Business Loan Program for GHG Emission Reduction

I. PROGRAM DESCRIPTION

The proposed Business Loan Program for GHG Emissions Reduction will be a $60 million facility aimed at promoting the use of energy efficient and renewable energy solutions in the Mongolian MSME market. MSME’s make up more than 90% of the businesses in Mongolia, the majority of which are currently using extremely outdated and inefficient equipment, processes and buildings. The program’s main objective is to promote both the use and production of EE/RE products in the domestic market. Of the total $60 million program, $20 million would be funded from the GCF, which allows XacBank to improve its lending terms (longer loan tenor and lower interest rate) through blending with its current EE/RE funds, including the GCPF GHG emission reduction program, which this program will be an extension of.

Currently, XacBank has roughly 200 active corporate clients, more than 3,400 active SME clients (of 22,000 SMEs that have conducted business with the Bank over the years), and many more micro-sized clients at hand. As a result of this program, a paradigm shift can be achieved as many of these entities, as well as the rest of the roughly 60,000 registered MSMEs in Mongolia, will reap the benefits of a low cost, high efficiency loan product. Furthermore, as XacBank is the national implementing entity, the level of country ownership is extremely high, including working in concert with the NDA and engaging local stakeholders to ensure that the program will continue to align with Mongolia’s INDCs, NAMAs, as well as other relevant legislation, such as the Green Development Policy of Mongolia.

Additionally, the program will look to support women-led MSMEs as much as possible by offering more concessional loan terms to such entities. The definition of women-led MSMEs can be found in the Gender Action Plan as attached in annex 8. By the end of the third year of the program, the facility’s portfolio will be made up of at least 50% women-led MSMEs.

By implementing this program, it is estimated that the Bank would be able to finance projects to reduce carbon emissions by more than 1.2 million tons over its lifespan of 8 years.

II. ENVIRONMENT AND SOCIAL MANAGEMENT SYSTEM (ESMS)

The program’s environmental and social management system (ESMS) has been devised in accordance with the Performance Standards of the Green Climate Fund[1] and the Environmental and Social Standards of XacBank, as a GCF-accredited entity. The main purpose of this ESMS is to provide the mechanisms by which XacBank will avoid, mitigate, and manage any potential adverse environmental and social impacts of the supported subprojects and to enhance the program’s environmental and social outcomes.

At the time of program development, none of the future portfolio has been identified. No specific information on their geographical focus and type of projects they will focus on (size and technology), as well as their requirements in terms of land and local communities and terrestrial geophysical features, were available. The ESMS therefore will:

- Provide a framework and guidance that will ensure that the program supports subprojects that are committed and able to comply with the environmental and social safeguards standards of GCF and that of XacBank, as well as the national laws in their screening, categorization, approval, monitoring and reporting of renewable energy subprojects.

- Provide a reference tool and the processes for implementing subprojects according to environmental and social standards defined by GCF and the XacBank and in compliance with the applicable national standards.

[1] The GCF has adopted the Performance Standards of the International Finance Corporation and can be accessed here: http://www.gcfreadinessprogramme.org/sites/default/files/Environmental%20and%20Social%20Safeguards%20at%20the%20Green%20Climate%20Fund.pdf.

The guidelines and processes will be institutionalized in the program and enforced through the program implementation underpinned by the contractual provisions agreed with the subproject proponents. The program’s guidelines, procedures and mitigation requirements are in line with the requirements of the GCF and XacBank requirements.

III. SUB-LOAN TYPES AND POTENTIAL ENVIRONMENTAL AND SOCIAL RISKS AND IMPACTS

The program will support the development, installation, and operation of renewable energy projects in Mongolia through the MSMEs. Some of these projects however, pose environmental and social risks and have potential for adverse impacts to the communities and the environment. Avoiding and mitigating these risks and potential impacts are fundamental to the operations at the subproject and program levels.

Each of the subprojects will be categorized prior to the sub-loan approval based on potential risks associated with it as screened using XacBank’s risk screening procedure. In short, XacBank’s social and environmental risk screening process for this program is the same as is used for all loans issued by the bank.

All potentially supported subprojects will be screened for their potential environmental and social impacts. The majority of the subprojects might cause some level of environmental and social impacts that would fall under Category B and C risk categories of projects[2]. For Category B, the program requires the subproject proponent to carry out an Environmental and Social Impact Assessment (ESIA) or other appropriate environmental and social assessments that would also include management plans to avoid and mitigate the potential environmental and social impacts. For Category C subprojects, the program will require environmental and social screening by the subproject proponents.

The program will not support high-risk, Category A, subprojects where the environmental risks and impacts may be significant, unprecedented, and irreversible. It is therefore expected that none of the subprojects will be located in protected and/or critical habitats or culturally or socially sensitive areas and require massive displacement of communities including vulnerable population.

[2] The Green Climate Fund has adopted the Performance Standards of the IFC, including its project categorization.

IV. INSTITUTIONAL ARRANGEMENT FOR IMPLEMENTATION

XacBank (AE) will be the executing entity of this program. Sub-loans will be distributed through traditional channels at XacBank branches upon receiving the facility from the GCF.

XacBank will publicize this program as a new line of MSME loans, which must be used for products that achieve 20% reduction in energy usage or 20% reduction in CO2 emissions (15% for end-users)

The process of distributing Eco Business loans follows normal bank disbursal procedures with additional steps to ensure the 20% CO2 reduction is achieved. These ESS-relevant steps are as follows:

The Social and Environmental Manager, and the Legal and Compliance Officer will act on a full-time basis to coordinate and monitor implementation of the Bank’s Social and Environmental Policy. The Bank’s Compliance Officer and will compile and report on reviews of the Bank’s social and environmental compliance to the Social and Environmental Manager. Management of the Bank will promptly notify the Shareholders if they are replaced, or if any changes are made in these positions or their main responsibilities.

When an existing or potential sub-project for the GHG emissions reductions program here proposed makes application for any loan, the relevant credit officer will make an evaluation as to whether the loan would contravene the Bank’s Excluded Activities in A. This will be done through the process of discussion on relevant exclusions with that particular MSME client.

As part of the application process and appraisal process, the sub-project loan applicant is requested to provide a description of the project or activity for which he/she is seeking a loan, as well as information regarding materials to be procured, disposal plans, maps of relevant areas, and any further information that Compliance deems necessary. A credit officer makes an evaluation as to whether there are any environmental and social risks associated with the project. According to Safeguard Risks Categorization (Appendix H), a credit officer also makes an evaluation as to whether there are any environmental as well as social risks associated with the project. A credit officer will inform and advise that the sub-project is expected to comply with the environmental, health and safety requirements of Mongolian legislation relevant to the activity being financed.

The Bank’s loan contracts will include a requirement or representation that the borrowers’ activities are conducted in compliance with the applicable environmental, health and safety requirements of Mongolian legislation (or according to corrective actions agreed) and consistent with prohibited activity.

From the due diligence stage forward, Management of the Bank will pay due attention to the social and environmental issues that may arise from existing and prospective sub-projects. Loan proposals will include specific reporting on a prospective MSME’s business principles as they relate to environmental, social, health and safety considerations in operation. Analysis of proposed loans will also include identification of particular risks to the fulfillment of these principles and how those risks might be addressed and managed by borrowers.

The sub-projects of the GHG emission reduction program are required to abide by applicable environmental, occupational, health and safety requirements, and labor laws, rules and regulations, including prohibition of child and forced labor.

The Bank will also comply with all applicable environmental and social policies, covenants and guidelines of its holding company’s Shareholders. In addition, for loans considered by reasonable judgment to have a potentially significant and irreversibly damaging environmental impact, the Bank will obtain written confirmation from relevant Shareholder or other Investor that such projects comply with local regulations and applicable their environmental and social policies.

If a sub-project becomes involved in a prohibited activity or violates applicable social and environmental covenants or domestic laws and regulations, the Bank will use its best efforts to see that the client implements a corrective action plan. The Bank will monitor and support the implementation of corrective action plan, which will detail steps, costs and responsibilities for returning a sub-project to compliance. Should a borrower’s engagement in a prohibited activity become intractable, the Bank will use reasonable efforts to seek repayment of the loan.

V. ESS POLICY BACKGROUND

XacBank background

XacBank has a comprehensive SEMS in place already, based on its established Social and Environmental Management System, and will apply it to the MSME program. This ensures that sub-projects financed through the program will comply fully with all requirements needed to ensure prevention and mitigation of environmental and social risks related to the implementation of these projects. XacBank will also define roles and responsibility for designated staff members for the oversight and on-going implementation of our SEMS. XacBank’s SEMS was internally adopted in 2002, with revisions made in 2008, 2011, and 2014, all of which were approved by XacBank’s Board of Directors.

The Bank is strongly committed to the principles of sustainable development as exemplified by the implementation of its ISO 14001-compliant Social and Environmental Management System (SEMS) to address environmental issues, both social and ecological, arising from the Bank’s operations since 2002. The Bank firmly believes that sustainable development can only come from educated and skilled people and businesses concerned equally about the Planet, People and Profit (3Ps). All employees related to the loan process and other processes, such as Procurement, receive regular trainings and workshops in applying E&S principles and procedures.

Also taken into consideration are the sub-borrower’s employee work place safety, health and hygiene practices and whether or not they cause any adverse effect to the local areas and community.

Mongolia’s Environmental Policies, Regulations, and National Priorities

The program is in line with a number of explicitly stated policy initiatives on the part of both the Mongolian government and the Ulaanbaatar municipality. Mongolia has submitted an Intended National Determined Contribution (INDC). The program here proposed is in line with Mongolia’s INDC as it incentivizes businesses to increase their renewable energy capacity and/or to provide products that allow consumers to increase their renewable energy capacity and their energy efficiency.

In 2016, the Mongolian government approved the Green Development Policy. One of the goals of the plan is to leverage tax, credit, and incentive mechanisms to finance a green economy. This program creates a facility that economically incentivizes green purchases for profit-minded SMEs.

In November, 2015, the Mongolian parliament passed the Energy Conservation Law (ECL). The ECL stipulates that large energy consumers (referred to as ‘designated consumers’) audit their energy usage and make plans to reduce their energy intensity by 15% in the course of 5 years after they have been appointed. XacBank’s new MSME program will be the private sector partner to this national policy ordinance, by providing the new designated consumers the financial support they need to implement the required changes.

In October, 2012, Mongolia’s Parliament adopted the Law of Mongolia on Environmental Impact Assessment. The law requires that any proposed project that will have an impact on the environment must a) inform and report on the implementation of environmental management plans to the local population, local government, and other stakeholders within the deadline specified by the Ministry of Environment; and b) prepare and submit to the Ministry of Environment a restoration and closure management plan for mining and petroleum projects not less than three years prior to proposed closure. Financiers of projects are legally barred from providing financial assistance to projects which are harmful to environment, society and human health. The EIA law also requires that in preparing an EIA report, the project sponsor must include minutes of meetings at which local people who are to be affected by a proposed project were consulted. The EIA Law authorizes the relevant minister to adopt detailed regulations on such public participation. However, the EIA law contains no objective criteria for what would be considered "harmful.” As such, the ESS policy for this program represents an extension and strengthening of this existing EIA law, with the addition of social elements. The program thus aligns with domestic INCD, NAMAs, and the Green Development Policy as well as the mission of the Green Climate Fund.

VI. SCREENING PROCEDURES

XacBank will categorize all projects under this MSME program into three categories:

| Category | Environment | Involuntary | Indigenous Peoples |

A | A proposed project is classified as category A if it is likely to have significant adverse environmental impacts that are irreversible, diverse, or unprecedented. These impacts may affect an area larger than the sites or facilities subject to physical works. | A proposed project is classified as category A if it is likely to have significant involuntary resettlement impacts. The involuntary resettlement impacts of an supported project are considered significant if 200 or more persons will experience major impacts, which are defined as (i) being physically displaced from housing, or (ii) losing 10% or more of their productive assets (income generating). | A proposed project is classified as category A if it is likely to have significant impacts on Indigenous Peoples. The significance of impacts of an supported project on Indigenous Peoples is determined by assessing (i) the magnitude of impact in terms of (a) customary rights of use and access to land and natural resources; (b) socioeconomic status; (c) cultural and communal integrity; (d) health, education, livelihood, and social security status; and (e) the recognition of indigenous knowledge; and |

| B | A proposed project is classified as category B if its potential adverse environmental impacts are less adverse than those of category A projects. These impacts are site-specific, few if any of them are irreversible, and in most cases mitigation measures can be designed more | A proposed project is classified as category B if it includes involuntary resettlement impacts that are not deemed significant. | A proposed project is classified as category B if it is likely to have limited impacts on Indigenous Peoples. |

| C | A proposed project is classified as category C if it is likely to have minimal or no adverse | A proposed project is classified as category C if it has no involuntary resettlement impacts. | A proposed project is classified as category C if it is not expected to have impacts on Indigenous Peoples. |

If the sub-project is evaluated as Category A, then the project will not be accepted to be financed by the program. Sub-projects in Category B, then the project will need to have an environmental and social impact assessment. In cases of sub-projects being evaluated in Category C, then the project will be subject to an environmental and social screening, using the checklist.

Environmental and Social Responsibility Risk Evaluation

Risk evaluations are carried out for all Bank loans that are more than MNT 50,000,000 (approximately US$20,000) and have tenors more than 12 months, based on a comprehensive scorecard, including sections on environmental, social and labor, compliance, and local area and community issues. Each category is rated from 6 to 1, with 6 being the least risky and 1 being the most risky. The Bank is determined to demonstrate the utility of its SEMS to its stakeholders, including clients, and through stakeholder engagement, closely monitors the environmental and social performance of its borrowers and actively manages any instances of non-compliance to rectify such situations.

Each sub-project under the MSME program will be considered on a case-by-case basis. When evaluating the environmental and social risks associated with a sub-project, the Bank will consider a wide variety of factors, including, but not limited to, the following:

- Nature of the sub-borrower’s business (e.g. micro, small, or medium-sized or large enterprise, business sector).

- Does the sub-borrower have any particular current exposures that represent high environmental and social risks?

- Does the sub-borrower have appropriate waste management solutions?

- Does the sub-borrower have any water pollution management?

- Do the sub-borrower’s activities cause any damage or contamination to the local soil or cause excessive dust?

- Does the sub-borrower’s activity cause any undue air pollution?

The environmental and social due diligence for PFI projects will start with questionnaires, which must be completed by the sub-project owners and submitted to the XacBank for review. Based on this information, XacBank will determine:

- Whether further environmental and social investigation is required;

- If the sub-project needs additional requirements;

- If there is a need for training to strengthen the environmental, social, and/or human resources management capacity of the sub-project owner; and

The nature of the reporting and monitoring requirements to be imposed on the project.

VII. ESMS IMPLEMENTATION ROLES

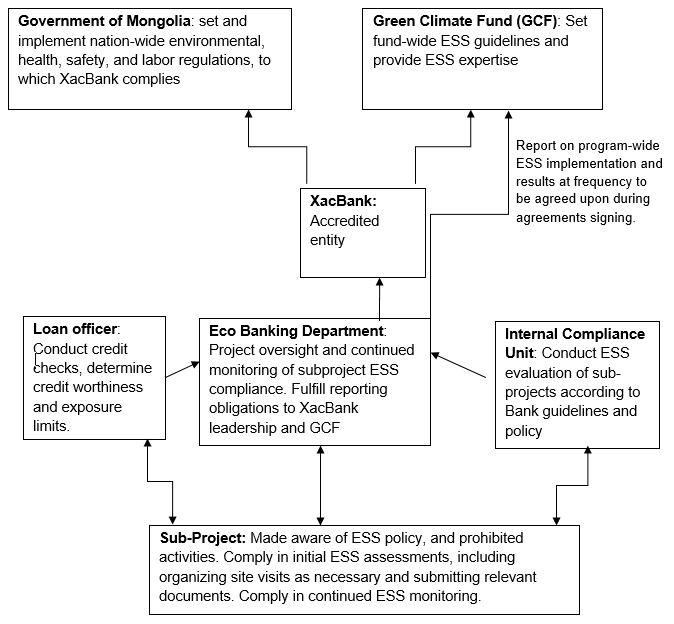

The SEMS will be implemented by the relevant departments of the Bank. Individual sub-project screening will be done by the relevant particular loan officer. SEMS evaluations will be done through the Bank’s Compliance Unit. The sub-project implementer will also submit on-going, periodic reports to the Bank. Monitoring and reporting thereafter will be handled by the Eco Banking Department. For more on the internal roles for this process within XacBank and the obligations of each party and institution, see the below organigram.

VIII. STAKEHOLDER ENGAGEMENT PROCESS

XacBank has well-established processes for engagement with relevant stakeholders as well as civil authorities so as to ensure ownership and ESS compliance. These processes are detailed below.

Stakeholder engagement process with funding partners

Since 2012, XacBank has worked closely with multiple stakeholders for the existing Business Loan Program for GHG Emission Reduction, the two main being the EBRD, GCPF, with the soon to be added DWM Securitizations. As GCF funding is disbursed to XacBank to expand the existing program, the GCF will become the fourth main stakeholder.

Furthermore, XacBank has also worked with IFC, Deutsche Bank, ADB, and others on the energy efficiency market for businesses in Mongolia. Through its Compliance Unit, XacBank provides annual reports on environmental and social practice to the Mongolian Bankers Association (as part of the Sustainable Finance Initiative), EBRD, FMO (Netherlands), MEF and GMF (Luxembourg), Global Climate Partnership Fund (Luxembourg), DEG (Germany), OeEB (Austria), Proparco (France), in conformity with the respective credit agreements and the Shareholders’ Agreement. For the MSME program, XacBank plans to continue these reporting practices and standards.

Stakeholder engagement process with the NDA

XacBank has an established relationship with the NDA. The AE has worked closely with the NDA as well as other civil authorities, such as the Ulaanbaatar Municipality, on the implementation of previous projects. Government entities have been consulted on both a formal level, as in the case of the No Objection Letters, and on an informal level, as valuable consultative assets.

These stakeholder engagement processes have already been activated for this program. The NDA has been consulted on the development of the concept note related to this funding proposal, contributing valuable insight into possible ESS risks, and has indicated their support for the project through the signing of a No Objection Letter. Lines of communication between the FP and the NDA will continue to be utilized in later stages of program development, such as during implementation, and when relevant new legislation is passed.

Sub-project stakeholder engagement

Engagement of sub-project leaders is crucial to the success of the implementation of this ESS. Sub-project leaders will be made aware of the program’s environmental and social standards to which the sub-project will be held. A project-based ESS evaluation is a crucial element of project eligibility and will be conducted by the FP through evaluating project materials (construction plans, procurement plans) as well as in-person site visits. These evaluations will be collaborative, with XacBank suggesting ways for the sub-project to mitigate environmental and social risks. Engagement will also continue into the sub-project implementation, with the XacBank team making themselves available for ESS related clarification questions, and engaging in continual monitoring. See below section “Monitoring” for further details.

Stakeholder engagement process with civil society organizations

The program has in place a robust pipeline of civil society engagement events, so as to receive private sector inputs on possible risks, as well as to educate potential clients on the high ESS standards to which this program is held. Two main avenues exist for both publicizing the program’s features and soliciting feedback: Business Council of Mongolia (BCM) and the American Chamber of Commerce (AmCham) in Mongolia.

In addition, XacBank plans to engage local NGOs and public-sector organizations. The Green City Association and the Building Energy Efficiency Center (affiliated with the Mongolian University of Science and Technology) are two examples of this. The FP will work together with these organizations to help XacBank define baselines and make comprehensive measurements, so as to ensure the strongest possible environmental products are integrated into businesses through the program.

Gender-sensitive stakeholder engagement

As the program is highly targeted toward women-led SMEs, it is increasingly important that women from both a client and a partner side are consulted in decision-making and program design. In this way, the social risks of gender-exclusion based upon program design or program implementation will be limited. In 2014, XacBank ran a focus group with women-led SMEs to understand their specific financing needs. The results of this study were used in the design of the program. Finally, XacBank has utilized the GCF’s gender resources and expertise through consultative meeting and the development of a strong Gender Action Plan, whose implementation will limit ESS-related risks.

IX. GRIEVANCE REDRESS MECHANISM (GRM)

Program level

Grievances from stakeholders and potential affected communities and households are received by the Bank through dedicated channels, including a dedicated phone line, 24-hour online chat system, as well as an email address. The GRM will not preclude or impede access to the judicial or administrative remedies, and XacBank will appropriately inform each sub-project and its affected stakeholders of the GRM during the engagement process.

After receipt of any complaints, they are to be handled in accordance with the Bank’s internal policies and procedures, including, but not limited to, the Investigation Procedure, which outlines step-by-step the process of receiving grievances, categorizing them, investigating the case, complaint resolving, dispute settlement, and the appropriate corrective actions to be taken.

Sub-project level

The GRM will be scaled to the risks and adverse impacts of the project and will be elaborated in the environmental assessment and evaluation of each individual sub-project. The GRM will be discussed during consultations with sub-project owners, and its affected stakeholders to ensure it is both fit for purpose and appropriate to the social and cultural context of the project level.

All grievances received by XacBank regarding any sub-projects under the MSME program will be entered into a register with the date, name, contact details and the reason for the complaint. A duplicate copy will be made and given to the complainant for the record at the time of registering the complaint. Minor complaints, which can be resolved quite easily and acted upon immediately, can be addressed at the sub-project level by the sub-project owner and/or the Bank, if necessary. Where the complaint is of a more serious nature, the sub-project owner and/or the Bank has up to 20 business days to resolve the complaint.

There will be no costs associated with making any complaints. Should the complainant not be satisfied with the measures taken to address their grievance, they may, at their discretion, go through the appropriate channels to pursue further action, at the complainants’ own cost. If requested, the complainant has the right to their anonymity. The resolution of complaints will be handled in a fair, transparent and inclusive manner and will be guided by stakeholder engagement and dialogue. After the complaint has been resolved, the situation will be continually monitored to ensure that the same issues will not arise again.

The Bank will keep a register of all received complains along with their status and will ensure that they are resolved.

Programme-related grievances may be filed by any affected party through the Grievance Redress Mechanism (GRM) found here. Grievances will be handled in accordance with the bank’s procedure on receiving and resolving complaints and feedback which may be consulted here.

Grievances related to the programme may also be filed to the GCF directly through their Independent Redress Mechanism (IRM) at https://irm.greenclimate.fund/.

X. MONITORING ARRANGEMENTS

All sub-borrowers will be required by the Bank to submit environmental and social reports on an annual basis according to the format provided by the Bank. The format will integrate the Environmental and Social Responsibility Risk Evaluation, which is a comprehensive assessment comprising environmental, social, labor, compliance, and local area and community issues. The Bank reserves the right to conduct site visits to financed sub-projects to monitor the implementation of the Bank’s requirements as necessary.